General regulations

a) Cause

The

retirement or retirement of civil servants may be produced in various circumstances:

b) Period without coverag

In order to be entitled to an ordinary retirement or retirement pension a minimum period of

15 years of years serving the State is required.

c) Pension Calculation

The amount of the ordinary pension is determined by applying the corresponding

regulatory basis , according to the Corps or category of the civil servant, the

percentage established depending on the number of full years of effective service to the State.

Regulatory bases (bases for the calculation of the Passive Class pensions): they are set annually in the Law of General State Budgets for each group, subgroup (Royal Legislative Decree 5/2015, Basic Statute for Public Employees) of classification in which the different Corps, Scales, posts or jobs of civil servants are included.

For 2023 they are as follows:

Grupo / Subgrupo EBEP | Haber regulador

(euros /año) |

|---|

| A1 | 48.086,76 |

| A2 | 37.845,48 |

| B | 33.139,86 |

| C1 | 29.065,98 |

| C2 | 22.996,00 |

| E (Ley 30/1984) y Agrupaciones profesionales (EBEP) | 19.605,93 |

- The relevant

percentage will be applied to the corresponding base or regulatory base according to the following scale:

Años de servicio | Porcentaje del regulador | Años de servicio | Porcentaje del regulador | Años de servicio | Porcentaje del regulador |

|---|

| 1 | 1,24 | 13 | 22,10 | 25 | 63,46 |

| 2 | 2,55 | 14 | 24,45 | 26 | 67,11 |

| 3 | 3,88 | 15 | 26,92 | 27 | 70,77 |

| 4 | 5,31 | 16 | 30,57 | 28 | 74,42 |

| 5 | 6,83 | 17 | 34,23 | 29 | 78,08 |

| 6 | 8,43 | 18 | 37,88 | 30 | 81,73 |

| 7 | 10,11 | 19 | 41,54 | 31 | 85,38 |

| 8 | 11,88 | 20 | 45,19 | 32 | 89,04 |

| 9 | 13,73 | 21 | 48,84 | 33 | 92,69 |

| 10 | 15,67 | 22 | 52,52 | 34 | 96,35 |

| 11 | 17,71 | 23 | 56,15 | 35 ó más | 100 |

| 12 | 19,86 | 24 | 59,81 | | |

Calculate the amount of your future pension

Special circumstances

a) Services rendered in two or more Corps

When services have been rendered in two or more Corps of categories with a different regulatory base, the whole administrative record of the civil servant will be taken into account to calculate the retirement or discharge pension from the moment they joined the first Corps and any other successive corps until they left active service. The following formula will be applied:

P = R1 x C1 + (R2 - R1) x C2 + (R3 - R2) x C3 + ….

With:

P is the amount of the retirementor retirementpension

R1, R2, R3... the regulatory bases corresponding to the first and successive Corps and Scales where the person has been employed

C1, C2, C3.... the percentages of calculations corresponding to full years of effective service rendered since they joined the first Corp, Scale... until retirement or discharge, in accordance with the previous percentage table.

To determine the applicable percentage, the fractions of time above one year will be calculated as time corresponding to the services rendered subsequently until the services rendered last, where the surplus resulting time will not be counted.

b) Pensions in the event of an extension in the term of active service

In accordance with the amendment introduced by Law 21/2021, of 28 December, on guaranteeing the purchasing power of pensions and other measures to reinforce the financial and social sustainability of the public pension system, to the seventeenth additional provision of the

Consolidated Text of the Law on State Pensioners’ Pension Scheme, approved by Royal Legislative Decree 670/1987 of 30 April 1987, the provisions of Article 210(2) of the revised text of the General Social Security Act, approved by Royal Legislative Decree 8/2015 of 30 October 2015, shall apply to retirement pensions under the State Pensioners’ Pension Scheme accruing from 1 January 2022.

- As a general rule, it shall apply to retirements declared at an age above the compulsory retirement age corresponding to the Corps to which the official belongs, provided that, on reaching this age, the minimum qualifying period of 15 years is met.

- In the case of Judges, Justices, Tax Lawyers, Prosecutors, Lawyers of the Justice Administration, University Lecturers and Property, Company and Movable Property Registrars who become eligible for a pension from 1 January 2015, they will be required, at the time of retirement, to be at least sixty-five years of age, as will be the Justices and Prosecutors of the Supreme Court who, on the indicated date, were emeritus.

A financial supplement shall be paid to the person concerned for each full year of actual service with the State that has elapsed since he/she became eligible for this pension, payable in one of the following ways, at the choice of the person concerned:

a)An additional 4 per cent for each full year of contributions made between the date on which he/she reached that age and the date of the event giving rise to the pension.If the amount of pension with the increase exceeds the maximum limit of perception of public pensions (3,058.81 EUR/month for 2023) an additional amount will be received which added to the pension may not exceed the regulator having of Group / Subgroup A1 (3,434.77 EUR/month for 2023).

3,434.77 euros – 3,058.81 euros = 375.96 euros/mes.

Receipt of this supplement is incompatible with the pensioner’s being employed or self-employed in any other way which would entitle him/her to be included in any public Social Security scheme.

b) A lump sum for each full year of contributions paid between the date on which he/she reached said age and that of the event giving rise to the pension. This amount shall be determined on the basis of the years of contribution credited on the first of the dates indicated, calculated as follows:

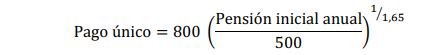

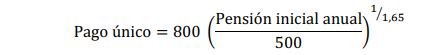

1.º If you have paid contributions for less than 44 years and 6 months:

2.º If you have contributed for at least 44 years and 6 months, the above figure is increased by 10%:

![]()

![]() c) A combination of the above solutions in the terms developed in the regulations, in accordance with Royal Decree 371/2023, of 16 May (BOE 117, of 17/05/2023).

c) A combination of the above solutions in the terms developed in the regulations, in accordance with Royal Decree 371/2023, of 16 May (BOE 117, of 17/05/2023).

To be eligible for this modality it is necessary that:

1) The pensionable event occurred on or after 19 May 2023 (inclusive).

2) At least two years have elapsed since the date on which the person concerned reached the mandatory retirement age.

Once these conditions have been met, if the person concerned chooses this option, the supplement will be calculated on the basis of the full years of State service attested, although the calculation rules are different depending on whether ten years or more than 10 years have elapsed between the date of compulsory retirement and the event giving rise to the pension:

• If between 2 and 10 years have elapsed between forced retirement and the pensionable event, an additional 4% is applied for each year of half of that period, and a lump sum for the remainder.

• If 11 years or more have elapsed between compulsory retirement and the pensionable event, a lump sum is applied for 5 years of that period, and an additional 4% for each of the remaining years.

The choice shall be made only once at the time of entitlement to the allowance and may not be changed thereafter. If this option is not exercised, the supplement referred to in point (a) shall apply.

The percentage increase obtained shall in no case affect the calculation of pensions in favour of family members.

c) Calculation of service in retirement or retirementpensions for incapacity or disability.

The retirement pension for permanent disability/incapacity for service is calculated in the same way as the ordinary retirement pension, with the exception that when the former occurs while the civil servant is in active service or an equivalent situation, in addition to the years of service so far completed, the complete years remaining in order to reach retirement age are also considered as effective service in the Branch, Rank, location, job or category occupied at the moment of retirement.

However

as of January 1, 2009, when, at the time the event occurs, the individual concerned accredits fewer than twenty years of service and the

disability does not prevent him or her from all professions or occupations the amount of the

ordinary retirement pension shall decrease by 5% for each whole year of service remaining until 20 years of service are reached, with a maximum of 25% for those individuals accrediting 15 years or fewer of service. If, after the pension has been recognised and before retirement age has been reached, the illness or injury of the individual concerned deteriorates in such a way that it prevents him or her from carrying out any profession or occupation, the amount of the pension may be increased by up to 100% of what would have corresponded to the individual.

d) Change of force to another with a higher proportionality index before 1 January 1985 -DT1 of the reformed text of the Civil Service Act.

The First Transitory Disposition of the

Codifying Legislation of the State Passive Class Law establishes that the civil and military civil servants of the State Administration who joined before 1 January, 1985, and who before that date had been transferred from one corps, scale, post or job with a given index of proportionality assigned to it to render services in another with a higher index of proportionality, will be entitled, for the calculation of their pension, to up to a maximum of ten years of the years effectively served in the corps, scale, post or job of the smaller of the indexes of proportionality, as if they had been rendered in the greater one.

Voluntary civil servant retirementorretirementpensions are excluded from this special service calculation.

e) Obligatory military service and Community Service

For the purpose of passive rights, obligatory military service and the equivalent community service – now suppressed - are only taken into account for the determination of the pensions of civil servants when they had been completed after they joined the Civil Service.

If these services had been done before admission to the civil service, only the time served beyond the obligatory military service period will be taken into account.

f) Reciprocal calculation of contributions between different Social Security systems

Royal Decree 691/1991, of 12 April, on the reciprocal calculation of contributions between Social Security systems, makes it possible, at the request of the interested party, to add up successive or alternative periods of contribution accredited in the State Passive Class System and in the different Social Security Systems, both for the accrual of entitlement to a pension and for determining the percentage applicable for the calculation thereof.

The pension is recognised by the Organ or Organisation Managing the System to which the last contributions had been made, applying its own regulations, albeit taking into account the sum total of the periods, unless the conditions required for entitlement to a pension in the system in question were not met, in which case the other system will prevail.

When recognition of the pension corresponds to the Passive Class System, the periods of contributions totalled and accredited in another system are understood to have been rendered in the group or category resulting from the application of the following

tables of equivalence:

|

Seguridad Social |

Régimen de Clases Pasivas |

|---|

| 1 (grupo 1 + Autónomos licenciados e ingenieros) | A1 |

| 2 (grupo 2 + Autónomos Ingen. Técnicos y peritos) | A2 |

| 3 (grupos 3, 4, 5, 8 y Autónomos en general) | C1 |

| 4 (grupo 7 y 9) | C2 |

| 5 (grupos 6, 10, 11, 12 y empleadas de hogar) | E / Agrupaciones profesionales |

In order to incorporate the years of contribution in the Civil Service Scheme into Social Security pensions, in application of the reciprocal calculation of contributions between Social Security schemes (Royal Decree 691/1991 of 12 April) the interested party must request certification of services provided to the State through Form CS issued by the ministerial department or Autonomous Community where the civil servant was last assigned.

g) Secularised priests and monks and nuns

Royal Decree 432/2000, of 31 March 2000, regulates the calculation in the State Passive Class System of the periods recognized as Social Security contribution periods in favour of Catholic Church priests, monks or nuns, as well as of lay members of any of the secular institutes of the Catholic Church entered in Ministry of Justice Register of Religious Entities at 1 January 1997 who has ceased to belong to the religious profession or to be a member of such secular institutes.

The aforementioned Royal Decree makes it possible to sum up these periods, at the application of the interested party and provided that they do not overlap with the years of service accredited in the State Passive Class System, both to be eligible for a pension in this social protection system and to improve the amount thereof, although in no case may the years resulting from the aforementioned summation surpass the figure of thirty-five.

The most relevant aspects to be taken into account are:

- The interested party's application should be accompanied by a

certificate, specifying the periods assimilated to recognized contribution periods and, when applicable, actual contribution periods, issued by the

Provincial Directorate of the General Social Security Treasury of the interested party's place of residence or, in the event of living abroad, by that pertaining to the place where he exercised the priestly office or religious profession at the time of his or her secularization, or as a lay member of a secular institute of the Catholic Church, at the time of his or her cessation.

- For the calculation of the pension, periods of priesthood or religious profession, which the General Treasury of the Social Security acknowledges as contributions, are understood as services rendered to the State in

subgroup C1.

- The interested parties are obliged

to pay exclusively the part of the total amount of the pension corresponding

to the years for which contributions are recognised as having been paid for the recognition of entitlement to pension or the improvement of the pension already recognised. This part will be calculated by applying, to the regulatory base of group C, the percentage established in the scale of article 31.1 of the Codifying Legislation of the Passive Class Law for an equal number of years to those for which contributions are recognised as having been paid. .

- The amount to be paid will be deduced in the successive monthly pension instalments that accrue, including extraordinary payments, although in no case may the monthly amount deduced be greater than the difference existing, on the starting date of payment, between the amount of the pension paid (following taxes) and that which would have corresponded without the counting of the years for which contributions are recognised as having been paid. This clause ensures that an amount larger than the amount by which the pension is improved as a result of the calculation of the years of religious employment will never be subtracted.

- The amount payable regarded as a tax-deductible expense, included in article 19 of Law 35/2006, of 28 November, on I.R.P.F. [Personal Income Tax]

h) Loss of the condition of civil servant

The personnel included in the subjective scope of the State Passive Class System -except those referred to in letters i) and j) of Article 2.1 of the

Codifying Legislation of the Passive Class Law - who

lose the condition of civil servant retain the passive rights that they may have acquired for themselves or their relatives until that moment.

However, such staff will acquire the right to an ordinary disability retirement pension only when they become totally incapacitated from following any trade or profession before reaching retirement age.

Acknowledgement of the civil service rights arising for these staff will always occur at the request of a party once the requirements have been met in each case. A prior declaration of retirement is not necessary.

i) Maternity allowance for retirement or forced retirement pensions or pensions for permanent incapacity/disability for service caused from 1 January 2016 to 3 February 2021

From 1 January 2016, women who have given birth to or adopted children and who are beneficiaries of a compulsory retirement or permanent disability for work pension will be eligible for a pension supplement of an amount equivalent to the result of applying to the pension for which they are eligible a percentage in terms of the number of children born or adopted prior to the event that gave rise to the eligibility for the pension, according to the following scale:

- In the case of 2 children: 5 per cent.

- In the case of 3 children: 10 per cent.

- In the case of 4 or more children: 15 per cent.

In no case will this maternity supplement be considered as part of the retirement or retirement pension for the purposes of determining the regulatory base in eligibility for pensions for relatives.

Moreover:

- If the pension to be supplemented includes periods in application of international regulations, the supplement will be calculated on the theoretical pension, which in no case may exceed the maximum limit of the public pensions.

- If the amount of the pension for which the person is eligible is equal to or greater than the maximum pension limit, only 50 per cent of the supplement will be paid, even in cases where there is a concurrence of public pensions.

- If the pension for which the interested party is eligible does not reach the minimum pension amount and she requests the minimum supplement and meets the eligibility requirements, the maternity supplement will be added.

- In the event of concurrence of public pensions, independently of the regulations under which they are paid, only one maternity supplement will be paid in accordance with the following rules:

If the concurrence is of more than one retirement

or retirementpension, the highest supplement will be paid.

If it is of a retirement or retirement pension and a widow’s pension, the amount corresponding to the retirement pension will be paid.

j) Allowance for the reduction of gender disparities.

The allowance for the reduction of gender disparities,

will only be recognised for pensions accrued from 4 February 2021 onwards..

Women who have had one or more children and who are in receipt of a retirement or compulsory retirement pension or a pension for permanent incapacity for service or uselessness in the Civil Service Pension Scheme shall be entitled to one allowance for each child. The right to the financial allowance for each child shall be granted or maintained to the woman, provided that the allowance is not applied for and granted in favour of the other parent, and if the other parent is also a woman, it shall be granted to the one who receives public pensions of a lesser amount.

In order for men to be entitled to the allowance, they must be in receipt of a retirement or compulsory retirement pension or a pension for permanent incapacity or inability to work and have interrupted and must have had their professional career interrupted or affected by childbirth or adoption, in accordance with the following conditions:

1st In the case of children born or adopted up to 31 December 1994, having more than 120 days without effective State service, in accordance with the provisions of Article 32 of the revised text of the Law on Pensionable Classes, between the nine months prior to the birth and the three years following that date or, in the case of adoption, between the date of the judicial decision establishing it and the three years following it, provided that the sum of the amounts of the pensions recognised is less than the sum of the pensions corresponding to the woman.

2nd in the case of children born or adopted since 1 January 1995, if the official has ceased active service or has had a reduction in working hours in the 24 months following the month of birth or the month of the court decision establishing the adoption, by more than 15 per cent in relation to the 24 months immediately preceding, provided that the sum of the amounts of the recognised pensions is less than the sum of the pensions due to the woman.

3rd If the parents are men and both of them meet the above conditions, the one who receives the smaller amount of public pensions shall be recognised.

The amount of the allowance for 2024 shall be 33,20 euros per month for each child. The amount to be received shall be limited to four times this amount.

In addition:

- The amount of the allowance shall not be taken into account in the application of the pension ceiling.

- The allowance shall be paid in fourteen instalments together with the pension entitlement.

- Each son or daughter shall only be entitled to the recognition of one financial allowance.

- The allowances that may be recognised in any of the social security schemes shall be incompatible with each other, and shall be paid in the scheme in which the pensioner has been registered for the longest period of time.

Transitional maintenance of the maternity allowance in pensions for Civil Service.

Those who were receiving maternity allowance will continue to receive it.

The receipt of this maternity allowance shall be incompatible with the allowance for the reduction of gender disparities that may correspond to the recognition of a new public pension, and the persons concerned may choose between one and the other.

In the event that the other parent of one of the children who was entitled to the maternity allowance requests the allowance for the reduction of the gender gap and is entitled to it, the corresponding monthly amount will be deducted from the maternity allowance already being received.